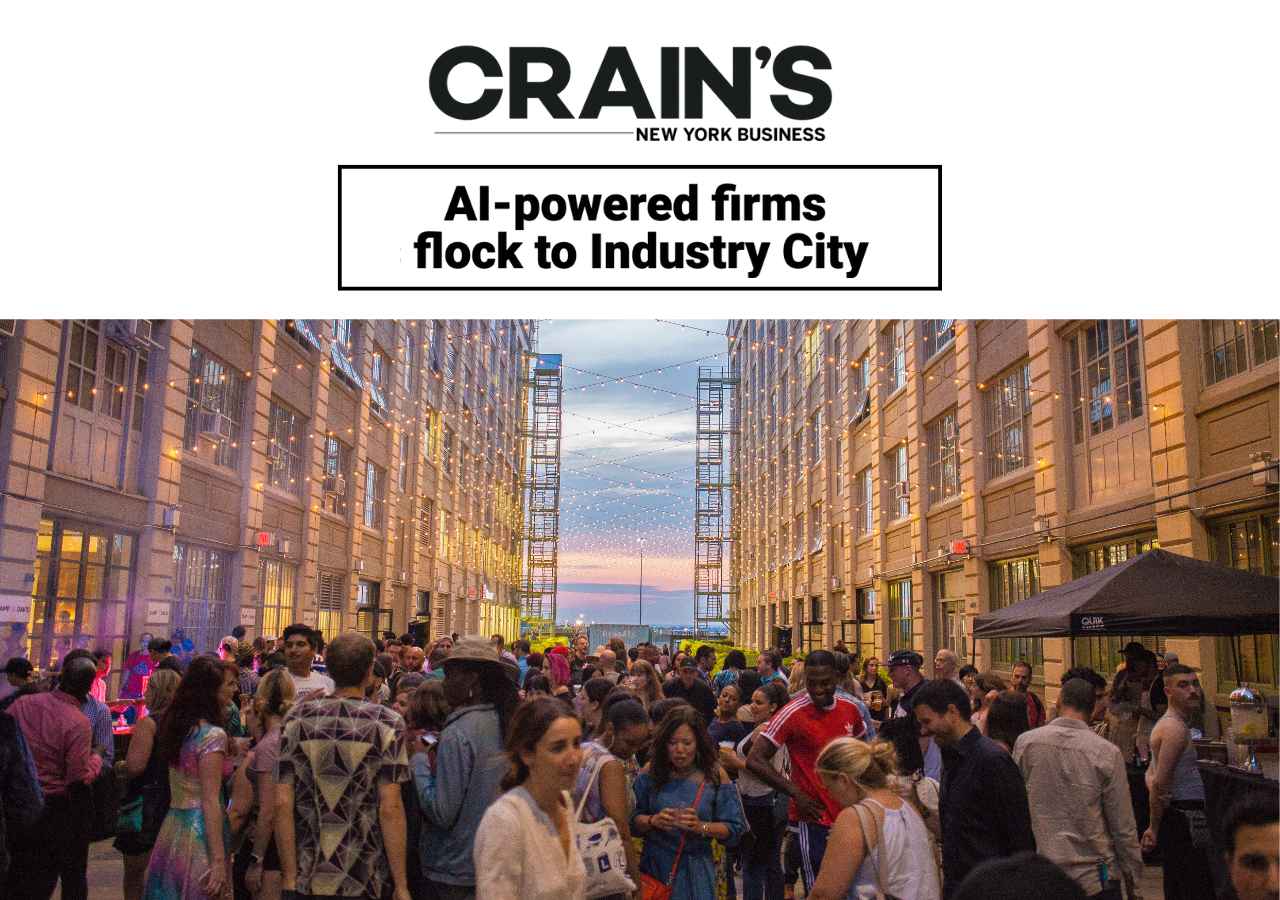

How Industry City has avoided a leasing slowdown during the pandemic

With office occupancy citywide hovering around 15%, Industry City in Brooklyn has been seeing roughly 50% of the campus’ employees come in to work.

Jim Somoza and Kathe Kramer Chase, the campus’ leasing executives, have managed to keep some tenants coming to their offices. At the same time, they’ve largely avoided the slowdown in office and retail leasing that many other landlords have experienced during the coronavirus pandemic.

The 35-acre, 6 million-square-foot campus along the waterfront in Sunset Park has inked 500,000 square feet in new leases since March 2020. Industry City’s ownership is led by Belvedere Capital, Jamestown and Angelo Gordon & Co.

Somoza and Chase recently spoke with me about who the new leases are with, what’s new at the campus, and how they’re creating an environment employees feel safe in amid the pandemic.

Industry City has leased over 500,000 square feet of space since March 2020. Who’s in the market for retail and office space?

Jim Somoza, director of development, on retail leasing: We’ve gotten a lot of interest from the last-mile delivery folks. One of the first deals we did was a deal with Whole Foods, slash Amazon, for what they call a dark store. When you go inside, it looks like a grocery store, just without all the fancy woodwork. We’ve gotten a few other inquiries like that that we continue to work on.

We’ve also gotten a lot of interest from car dealerships. Volvo came along and wanted to establish a dealership here. We’re kind of right in the middle [between Fort Greene and Bay Ridge], plus being on the BQE was something that was very attractive to them. [That space is] 25,000 square feet with the showroom and service center.

We also did another car dealership. It’s a very big and well-known brand. That’s about 50,000 square feet, which is about 20,000 square feet of showroom and parking for the new vehicles and a 30,000-square-foot service center. We are also getting close to a deal with another car company, which may end up being the last one.

We just renewed and expanded Restoration Hardware. All of our furniture and home goods retailers here are all trending up. All of their sales are higher than they were pre-Covid.

We opened a bookstore, Powerhouse Books. They’re doing four times the annual sales they first projected. It’s now their number one store.

We’re working on an expansion of Japan Village, another 20,000 square feet that’s all hard goods [like paper products, knives, cosmetics and pottery].

We’ve got a couple of other furniture dealers we’re working with now. We’re also relocating ABC Carpet.

How about on the office side, Kathe?

Kathe Kramer Chase, director of leasing: 50% of the office occupancy is back, and that’s a really robust number given what’s going on in the rest of New York City. Food is a big thing for us, companies related to food. Sometimes it’s commissary kitchens [like Union Square Events signing a lease for 70,000 square feet]. We have lots of companies that create content for food, so commercials, digital content.

There’s been this real trend toward hybrid spaces [with] companies that have their offices and distribution at Industry City. The other thing we’ve seen is a lot of makers coming back to work.

A lot of the big name brands that are in Manhattan are leasing satellite offices now, so we have a lot of big companies that are taking 5,000 and 6,000 square feet, either to dip their toe in the water or they’re doing this hub-and-spoke thing.

Why is Industry City’s office occupancy so high compared with the rest of the city on average?

Somoza: These buildings are almost skyscrapers put on their side. Most of them are only six stories high. You’re never in an elevator with a whole group of people, because our elevators are so spread out.

We’re blessed with these courtyards [that have heated outdoor space where people can sit outside]. We’ve been able to have this environment where people don’t feel crammed in.

Chase: There’s a modest amount of programming so it feels really nice when you come to work. It feels like a place you can go and feel an energy.

For the rest of 2021, what are your biggest challenges and opportunities?

Somoza: Biggest opportunity is to continue to do the kind of retail we’re doing. To me, the future of retail is — a lot of people use the word experiential — I like to use the word transport. What we do and try to do is do retail that is definitely interesting in that it should transport you in some way.

If you go through some of our spaces, Japan Village, you feel like you’ve gone into Japan. We do these things where it’s certainly shopping and certainly retail but it’s a transport to somewhere.

That was working very well prior to Covid and I think it works even better after because people are very hungry for experience.

The challenge for retail for the past decade has very much been Amazon [and the internet]. When you provide people that transportation somewhere that they don’t get on the internet, that’s how you address that challenge.

hase, on the office side: For 2021, I think we’ll be leasing to a lot of industrial users. The creative office users that need to be back in the office are looking for us because of where they feel comfortable asking their employees to come back to work. Food companies are calling us daily.

The challenge is companies waiting and seeing. They’re not sure what the office of the future looks like.

Have you seen any more interest in events since the vaccine rollout started?

Somoza: Outdoor markets, music and things like that, we used to do a lot of those. Six months ago, nobody was talking about anything like that. Now, we are getting a lot of inquiries.

*This is an article from New York Business Journal published on March 8, 2021; See the original article here.

Learn more about leasing space at IC here.